Marketing

The top 3 marketing challenges for small businesses (and how automation can solve them)

Do you ever wish you had a crystal ball to predict future problems in your business? If you could know...

Latest Blogs

Pick up recent small business trends and advice from our latest blogs.

Business Management

How to succeed in small business without sacrificing your personal life

Apr 15, 2024 · 6 min read

Customer Service

Play of the month: The power of dynamic email content for BarMD

Apr 05, 2024 · 4 min read

Marketing

Boost your SEO in 2024: Short-form video tips for high engagement

Apr 04, 2024 · 9 min read

Sales

How a small business CRM can help coaches and consultants close more high-value sales

Apr 03, 2024 · 8 min read

Business Management

Maximizing ROI: How to get the most value from your CRM for small business

Mar 21, 2024 · 11 min read

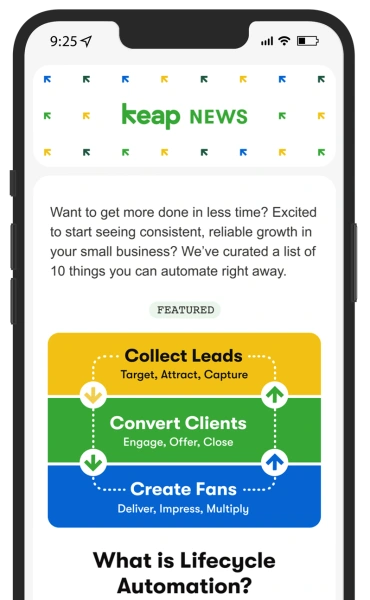

Subscribe to our newsletter

Sign up here for useful content, relevant posts, special offers, and upcoming events, delivered right to your inbox.